Introduction

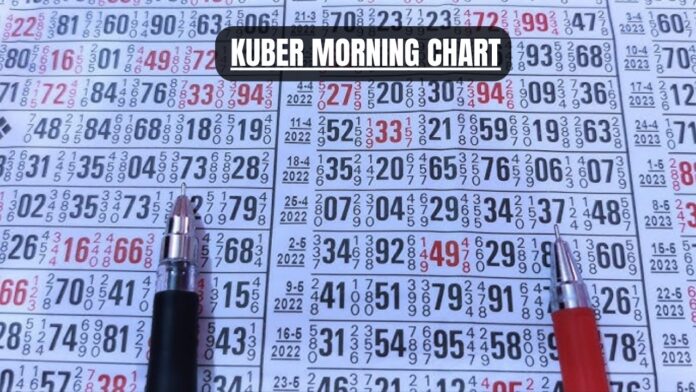

Kuber Morning Chart refers to a specific type of chart used in Satta Matka, a popular gambling game in India that involves betting on numbers. The morning chart typically provides players with the results of the previous day’s games and predictions for upcoming draws. It includes various combinations of numbers, known as “jodis,” which players use to place their bets. The chart is updated regularly to reflect live results, helping participants strategize their betting based on historical data and trends.

Why Use the Kuber Morning Chart?

The Kuber Morning Chart not only saves time but also offers immediate insights that eliminate unnecessary risks. With its precise daily breakdown, traders can create well-thought-out strategies and manage their capital efficiently. Here are some reasons why this tool holds significance:

- Daily Market Insights: It provides an overview of market trends and price shifts that are essential for short-term and day trading.

- Support and Resistance Levels: The chart identifies critical support and resistance points, helping traders predict possible price reversals.

- Trend Direction: By understanding the current trend, traders can decide when to enter or exit trades.

- Time Efficiency: The chart’s early insights allow for quick planning without spending hours on research.

The Kuber Morning Chart

The Kuber Morning Chart displays essential market indicators and price action information that traders need before the market opens. To fully understand it, let’s break down its core components and what each represents:

Core Elements of the Kuber Morning Chart

- Open, High, Low, Close (OHLC) Values: The chart shows the previous day’s OHLC, crucial for understanding the market’s sentiment.

- Price Momentum Indicators: Tools like RSI (Relative Strength Index) and MACD (Moving Average Convergence Divergence) display momentum.

- Support and Resistance Levels: Highlighted zones help predict potential market behavior at certain price points.

- Volume Analysis: Tracks changes in volume, which can indicate bullish or bearish trends.

Deciphering Price Action on the Kuber Morning Chart

Price action provides direct insight into how stock prices behave in different situations. By analyzing the price highs, lows, and any shifts from the previous day, traders can:

- Recognize breakout opportunities.

- Spot trend reversals before they escalate.

- Identify consolidation phases that may lead to future price movements.

Steps to Effectively Use the Kuber Morning Chart for Trading

To maximize the benefits of the Kuber Morning Chart, follow these steps to analyze the data and devise strategies that align with the chart’s insights:

Step 1: Analyze Market Trend Direction

Examine the trend direction to understand if the stock shows an upward (bullish) or downward (bearish) trend. The trend helps decide whether to focus on buying (if bullish) or selling (if bearish).

Step 2: Observe Support and Resistance Levels

Identify the major support and resistance levels on the chart. These levels indicate zones where the price may either bounce back or break through, guiding your entry and exit points effectively.

Step 3: Use Volume Indicators

Volume changes provide insight into the intensity of a trend. Higher volumes during upward movements signal strong bullish trends, while high volumes during declines indicate a bearish sentiment. Align your trades with volume trends for better outcomes.

Step 4: Track Momentum Indicators

Momentum indicators like RSI and MACD reveal overbought or oversold conditions, helping traders make wise decisions. If RSI shows an overbought condition, a price correction might be due, signaling a selling opportunity.

Step 5: Set Stop-Loss and Profit Targets

Use the chart’s data to set stop-loss levels that protect your capital from major losses. Similarly, define profit targets aligned with the chart’s resistance levels, ensuring you exit at optimal points.

Key Strategies for Trading with the Kuber Morning Chart

Developing effective strategies based on the Kuber Morning Chart ensures that traders make informed moves. Here are some popular strategies aligned with this chart:

Breakout Trading Strategy

The breakout strategy capitalizes on price movements that breach predefined support or resistance levels. Here’s how to use the Kuber Morning Chart for breakout trading:

- Identify Key Levels: Find the day’s support and resistance levels on the chart.

- Observe Volume: If a price breaks through a key level with high volume, it signals a valid breakout.

- Enter the Trade: Place buy orders above resistance levels and sell orders below support levels to capture potential gains.

Reversal Strategy

In reversal trading, traders anticipate a change in trend. The Kuber Morning Chart assists by identifying overbought or oversold conditions through indicators like RSI. Here’s the approach:

- Analyze RSI Levels: A reading above 70 indicates overbought, while below 30 suggests oversold.

- Confirm with MACD: MACD divergence strengthens the reversal signal.

- Plan Entry and Exit: Enter when the price starts reversing after a peak and exit when the reversal shows signs of weakness.

Gap Strategy

Gaps form when there’s a significant price difference between the previous day’s close and the opening price. The Kuber Morning Chart showcases these gaps, and traders can leverage them as follows:

- Identify Gap Patterns: Look for up gaps (bullish) and down gaps (bearish).

- Confirm with Volume: Ensure strong volume supports the gap.

- Enter Accordingly: Buy during an up gap and sell during a down gap for optimal returns.

Benefits of Using Kuber MorningChart in Trading

Leveraging the Kuber Morning Chart introduces numerous advantages that contribute to better trades and improved confidence in trading decisions.

Enhances Decision-Making Speed

With its immediate analysis, the chart enables traders to make decisions swiftly, a critical factor for success in fast-paced markets.

Reduces Risk

Accurate insights into support and resistance levels help in setting realistic stop-loss points, reducing exposure to unexpected price shifts.

Maximizes Profit Potential

By focusing on momentum indicators and volume, traders can align their trades with strong trends, maximizing their profit potential.

Reduces Emotional Trading

The Kuber Morning Chart’s data-driven approach minimizes impulsive decisions, helping traders avoid losses due to emotional trading.

Real-Life Applications of the Kuber MorningChart

Experienced traders and beginners alike can benefit from applying the Kuber Morning Chart in real scenarios. Here are some practical use cases:

Day Trading with the Kuber Morning Chart

For day traders, the chart provides critical insights needed for high-frequency trades. By understanding the trend direction early in the day, day traders can spot stocks with momentum and trade accordingly.

Swing Trading with Support and Resistance Analysis

Swing traders can utilize support and resistance levels on the Kuber MorningChart to identify potential reversal points, maximizing gains in medium-term trading strategies.

Scalping with Volume Analysis

Scalpers, who aim for quick profits, can benefit from volume analysis provided by the Kuber MorningChart. By focusing on stocks with significant volume changes, scalpers make precise entries and exits that maximize their returns.

Tools to Complement the Kuber Morning Chart

While the Kuber MorningChart itself is a powerful tool, pairing it with additional trading tools can enhance its effectiveness:

Technical Indicators

Combine RSI, MACD, and Bollinger Bands with the Kuber Morning Chart for a complete technical analysis, improving trend predictions and entry timing.

Candlestick Patterns

Candlestick patterns, such as Doji or Hammer, align well with the chart’s insights, adding depth to your analysis by revealing psychological patterns in price movements.

Market News Feeds

Integrate news feeds to stay informed about potential events or announcements that could impact stock prices, enhancing your Kuber Morning Chart analysis.

Tips for Success with the Kuber MorningChart

Here are some tips to optimize your success with the Kuber Morning Chart:

Keep it Simple: Focus on core elements like trend, support, and volume to avoid analysis paralysis.

Practice Regularly: Use the chart daily to become familiar with its patterns and signals.

Stay Updated: Market trends evolve, so keep up with new strategies that can improve your Kuber Morning Chart analysis.

Conclusion:

The Kuber Morning Chart proves itself as an essential tool for any trader aiming for consistent profits and informed decisions. By providing clear insights into market trends, price levels, and momentum, this chart simplifies the complex world of trading. Whether you’re a day trader, swing trader, or scalper, the Kuber MorningChart offers reliable insights to navigate the stock market confidently and strategically.

Also Read: GoMyFinance.com Invest: Guide to Online Investing Success

FAQs

How does the Kuber Morning Chart benefit traders?

The Kuber Morning Chart offers early market insights, enabling traders to make informed decisions based on trend direction, volume, and support/resistance levels.

What indicators are essential on the Kuber MorningChart?

Key indicators include OHLC values, support and resistance levels, RSI, MACD, and volume. Together, they give a comprehensive view of market conditions.

Can beginners use the Kuber MorningChart?

Absolutely. Beginners can follow simple steps to interpret the chart, and with practice, they’ll improve their accuracy in reading market trends.

Is the Kuber Morning Chart reliable for day trading?

Yes, its real-time insights and price action details make it particularly effective for day trading, allowing traders to act on timely data.

What is the best strategy for the Kuber MorningChart?

The breakout and reversal strategies work well, as they align with the chart’s indicators for identifying key levels and trend changes.

How often should I refer to the Kuber MorningChart?

Review the chart at the start of each trading day and before making significant trade decisions, ensuring you stay aligned with market trends.